Know how to check / track PAN application or PAN card status details by UTIITSL, TIN NSDL & e-Filling using acknowledgement, PAN Number, mobile & Aadhaar number.You can easily track a physical PAN card’s processing, dispatch, and delivery status via speed post, UTI, or NSDL by PAN number.

The PAN card is a special ID issued by India’s Income Tax Department. It’s required for filing taxes, opening bank accounts, and conducting significant transactions.

What Is PAN Card Status?

After PAN Card Apply, tracking the status details of your PAN application can save you from unnecessary anxiety. PAN card status indicates the current stage of your PAN card application, showing :

- Application Received

- PAN Approved

- PAN Card Dispatched

- Under Process (Verification)

- Held Up (Additional Info Required)

- Rejected (Incomplete/Inaccurate Info)

- Application Under Process: We’re reviewing your application.

- PAN Number Generated: Your PAN is ready; check your status for the number.

- Disposed: Your application is complete; expect the next steps soon.

- Sent to State Government - Your application has been sent to the State Government for checking.

Also check easy guide on PAN Card Forms 49a, required for new PAN card apply.

You generally receive your PAN card within 15 to 20 business days after applying.

How to Know PAN Card Status?

I will provide a simple guide on how to know your PAN card status details online, via UTI or NSDL websites, by SMS, or by calling the TIN call center.

Knowing the status of your application can provide peace of mind, especially if you need a PAN card for urgent financial transactions. Below are my favourite methods to know PAN card status:

1- NSDL

2- UTI

3- Name & DOB

4- e-Filling

5- Speed Post

6- Mobile number ( call & SMS ).

Below is an easy step-by-step guide for each method.

Track PAN Status Via NSDL

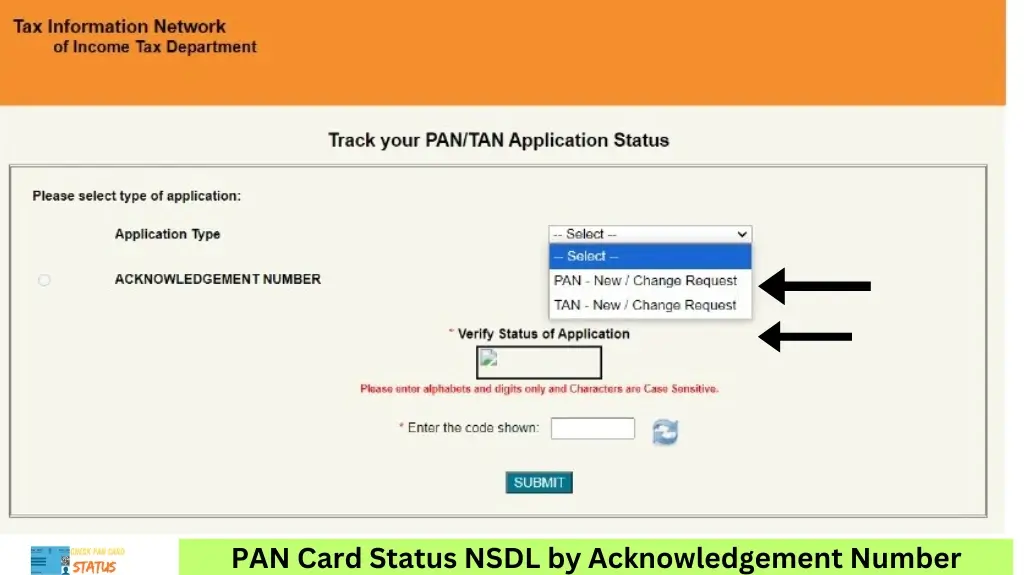

Here is a simple guide on how to check and track the status of a PAN card or PAN application online through TIN-NSDL (Protean) with an acknowledgement number. I often use this simple and straightforward method.

TIN (Tax Information Network) and NSDL (National Securities Depository Limited) offer a convenient online service for monitoring your application’s progress. Here are simple steps:

- Visit TIN NSDL PAN/TAN Status page..

- In the application type, click on the “select” dropdown menu.

- Select “ PAN - New / Change Request “ from the dropdown menu.

- Enter your 15-digit acknowledgement number.

- For security purposes, enter the captcha code displayed on the screen

- Once you’ve entered your details, click ‘Submit’ to view your PAN card application status.

Acknowledgement Number

The Acknowledgement Number is a unique 15-digit number assigned to your PAN card application when you submit it online (through UTIITSL or NSDL) or offline.

Check PAN Status Via UTI

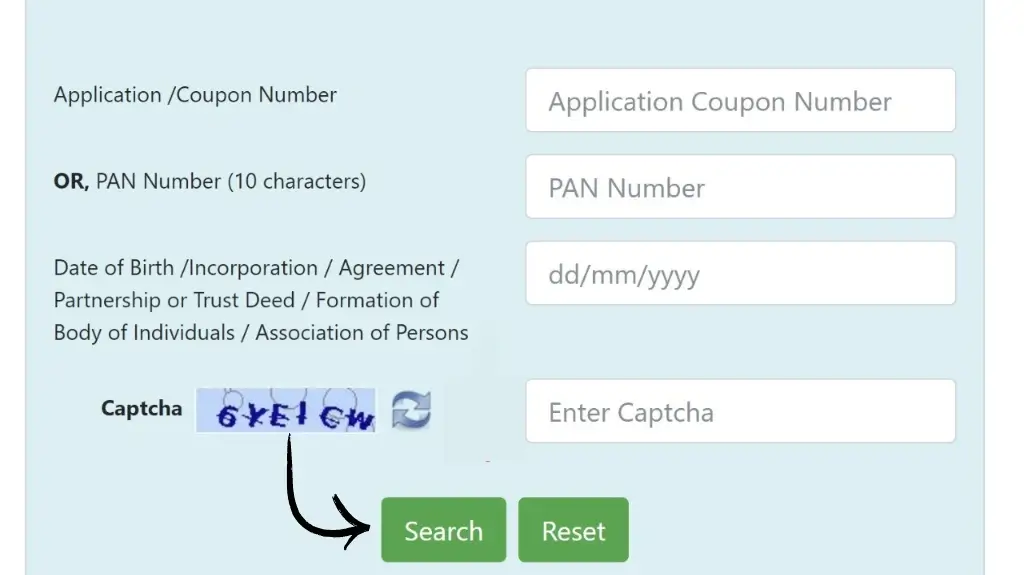

This guide clearly explains how to check / track your PAN card or PAN application status via UTIITSL using your PAN number or application coupon number. Its also my favourite and reliable method to check PAN status. Follow these simple steps.

- Visit the UTI PAN Track page.

- Choose either “PAN Number” or “Application Coupon Number” to track your status.

- If you are using the PAN number, enter your 10-digit PAN.

- If you are using the application coupon number, enter the appropriate number.

- For individuals, enter your date of birth. For entities, provide the date of incorporation, agreement, or partnership.

- Enter the CAPTCHA code and click “Submit” to view the status.

If you can’t read the captcha code, click the double arrow icon to get a new one.

The system displays your PAN card application status, including processing and dispatch updates. For assistance, UTIITSL provides customer support via helpline (+91 33 40802999, 033 40802999) and email([email protected]).

Application Token/Coupon Number:

The PAN application coupon number is a unique code assigned to your PAN application when you submit it, particularly in the context of offline applications or if you’re using certain online services. We can easily check/track our PAN card or PAN application status by using the application coupon number or token number through UTI.

PAN Number

A PAN is a unique permanent 10-digit alphanumeric code for taxpayers in India, used for income tax identification and required for financial transactions over ₹50,000. If you want to check the details of an already issued PAN card, you will use your PAN number.

PAN Status By Name & DOB:

Without an acknowledgment number, you can track PAN application or check PAN card status by name and date of birth (DOB) online through TIN-NSDL. These are the following steps. We can also do PAN Card Verification with name and DOB.

- Visit the NSDL (now known as Protean) website and go to the NSDL Status Track page.

- In the application type, click on the “select” dropdown menu.

- Select “ PAN - New / Change Request “ from the dropdown menu.

- 4. Enter Your Name: Fill in your first name, middle name, and last name as they appear on your PAN application. For non-individual applicants, enter the name in the Last Name/Surname field. Name should be as mentioned in the application form

- 5. Enter Date of Birth: Provide your date of birth or the date of incorporation/agreement/partnership/trust deed/formation of a body of individuals/association of persons.

- 6. Submit: Click the “submit” button to check the status.

Note: Applicants should check the status of their PAN application using their Name and Date of Birth 24 hours after submitting the application online or through a TIN-FC (Tax Information Network - Facilitation Center).

PAN Card Status Check By Mobile Number

You can easily check your PAN card status by mobile number through SMS and TIN call center with acknowledgement number. It’s a convenient and straightforward process.

- By Phone Call:

- Call the TIN customer care helpline at 020-27218080.

- Provide your acknowledgement number to the customer care executive, who will then inform you of your PAN status.

- By SMS:

- Send an SMS with your 15-digit acknowledgement number to 57575.

- You will receive an SMS with the status of your PAN card.

Check e-PAN Status Via e-Filling

You can easily check, track, and download the status of an Instant e-PAN card or application through the income tax e-filing online by PAN and Aadhaar number. Follow these steps !

- Visit the official Income Tax e-filing portal.

- Click on “Instant e-PAN” and Check Status/Download PAN.

- Enter your Aadhaar number and complete the OTP verification process.

- Once verified, your e-PAN card status will be displayed.

E-PAN Card: An e-PAN card is a paperless digital version of the PAN card issued by the Income Tax Department. It is a valid document that contains your PAN. Check easy guide on how to download e-PAN Card.

Instant e-PAN is a specific type of e-PAN that is issued immediately after a successful application, particularly for applicants who use their Aadhaar number for verification. It is designed for a quick PAN allotment process.

PAN Card Speed Post Tracking

Visit the India Post website or go directly to the consignment tracking section and enter the 13-digit consignment number and the security code. Click “search” to see your PAN card’s current status, location, and expected delivery date.

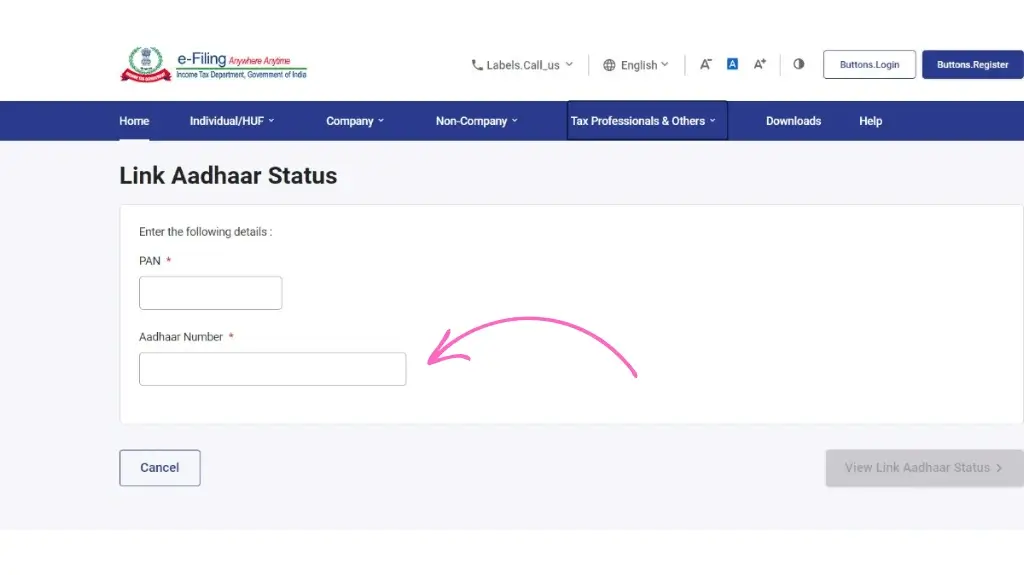

PAN Aadhaar Link Status

PAN-Aadhaar link status can easily be checked online through the Income Tax e-filing portal using PAN number and Aadhaar number.

To check the PAN-Aadhaar link status, visit the Income Tax e-filing portal and navigate to the Link Aadhaar Status option under the Quick Links section.

- Enter your PAN and Aadhaar numbers, and click on View Link Aadhaar Status.

- The system will display whether your PAN is linked to your Aadhaar.

- If the linking is still in progress, you will see a message indicating that the request has been sent for validation.

- Keeping your PAN and Aadhaar linked helps avoid issues such as higher tax deductions and ensures smooth financial operations.

- Not linking your PAN with Aadhaar can result in an inactive PAN card, disrupted financial transactions, and difficulties filing tax returns.

Aadhaar Number

An Aadhaar number is a unique 12-digit ID issued by UIDAI to Indian residents based on biometric and demographic data. It serves as proof of identity and address and is used for accessing government services, opening bank accounts, and more.

Common Questions about PAN Card Status

Solutions To Common Problems

If your PAN card application is rejected, ensure all details are accurate and complete before resubmitting to avoid future rejections.

If you’ve lost your acknowledgement number, contact the issuing authority for help in retrieving it. This number is crucial for tracking your application status and making corrections.

Conclusion

Regularly checking your PAN card status keeps you updated and helps resolve issues quickly, ensuring smooth financial transactions without delays.

For any issues or further assistance, you can contact the PAN card helpline or visit the nearest PAN card center.

Call to Action

Links to official websites for checking PAN card status